Get your business' refund

Up to $26,000 per employee to hire and retain employees use on operating expenses pay off debt|

What is the ERC?

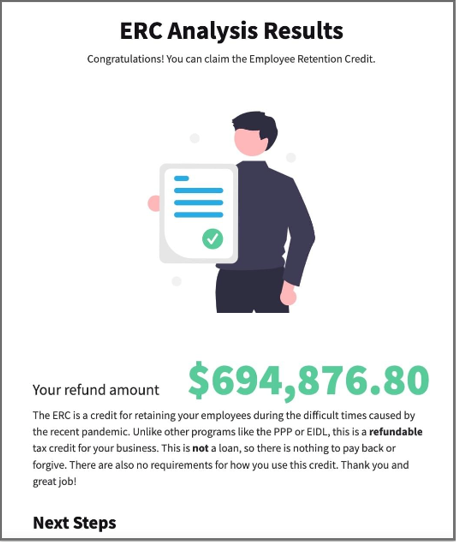

The Employee Retention Credit (ERC) is a payroll tax refund from the United States Treasury Department applicable to businesses who kept employees on payroll during the pandemic.

Who We Are

with Erc Straightline, we make it simple to claim the capital that’s yours to cover operating expenses, grow your business, hire quality talent, pay off debt, build a safety net, and so much more. How much money could be waiting for your business?

Michael W

Chief CPA and Executive

Michael is a hands on accounting, finance, treasury and operational executive with Big 5 public and private accounting and entrepreneurial experience. He graduated Cum Laude with a degree in accounting and finance from the University of Montevallo in 1999. He earned his CPA license while working at Arthur Andersen.

In 2002, he moved to Greensboro, North Carolina to work in internal audit for one of the world's largest apparel manufacturer. After 2-years of the corporate life, he decided to open his own business and grew to over 18 locations with 160 employees across the southeast .

He sold his business after close to 10 years and worked with other small to medium businesses on his own before joining a large national small business consulting firm where he traveled across the country. He worked closely with small growing companies, helping them bring order to their accounting and finance departments.

Now, Michael as Head CPA of ERC Straightline Focuses Primarily on Mastering the intricate details of ERC to help businesses maximize the Grant beneifits of ERC. On this journey he has now helped hundreds of companies throughout the United States and looks forward to helping you.

Our clients have claimed over $400MM+ in payroll tax refunds

HOW IT WORKS

We make claiming the payroll tax refund easier

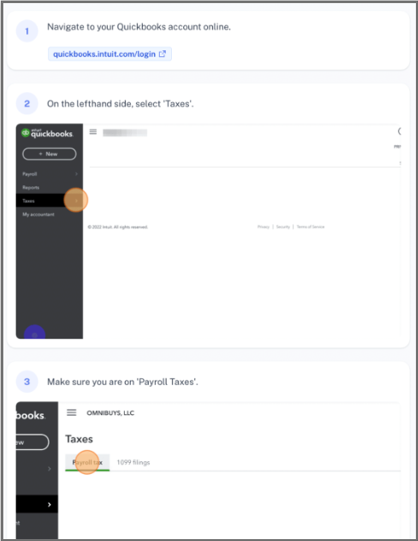

1: Enter Your Information

Fill in your Information here online & See how much you Potentially Qualify for Instantly!

2: Speak To Our Team

After Applying our Team will reach out to you to get the appropriate documents to have our Expert CPA/ERC team File for you! We charge nothing upfront!

3: Receive Check

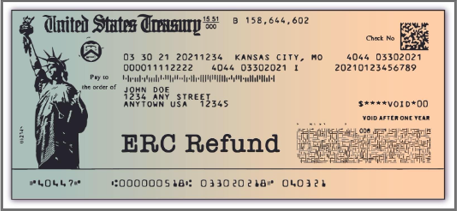

Once we Apply, Be patient & Wait for your certified Grant check directly from the IRS.

Only once you’ve received your check, You pay our Service fee for our great work! Its that Easy!

Frequently Asked Questions

FAQ

There are over 70,000 pages of tax code; it’s impossible to be an expert on all of them. ERC is all we do. It’s like the difference between your family doctor and a neurologist. By concentrating on this one program, our strategic partners understand the intricacies and nuances involved in determining your eligibility and accurately calculating your refunds.

Refer your friends to us and you can earn even more money for every successfully qualified application.

To check the status of your refund, you can call the ERC Straightline directly at (877) 777-4778. You can also always reach out to your Customer Service Champion for any updates throughout your refund process.

Due to the Employee Retention Credit, the ERC Straightline is currently working through a backlog of amended Form 941 filings. This means you could experience an extended wait time before you receive your refunds.

Our customers have recovered over $3 billion dollars in refunds for qualified businesses—sometimes for companies that were previously told they did not qualify. It won’t cost you a penny to see how much your company may recover.

Determining the proper amount of a refund is a complex accounting process. Although these are payroll tax credits, what you’ve paid in payroll tax has no bearing on your ERC calculations. The refunds are based on many factors including qualifying quarters, number of employees, hours worked, wages paid and if applicable, PPP loans, group health premiums and participation in other government programs to name a few.

As of 2022, ERC Straightline processing times for receiving your business’s refund check from the US Treasury is on average 4.5 months.

There are no up-front fees or obligations to receive your refund analysis. Once engaged in recovering your business’ refunds, our fee is 25%, with no hidden costs. You will never come out of pocket to pay our fee. We’re paid only as your business receives its refund check. Our fee includes the preparation of your claims by a professional CPA or tax attorney who is experienced in qualifying, substantiating, calculating, and claiming ERC refunds.

Absolutely! Both Essential and Non-essential businesses alike can qualify, and a decline in revenue is not required. Many of our clients even had increases in sales, but still experienced disruptions or were negatively impacted.

Unlike PPP, this is not a loan. It’s money for your business, and it’s up to you how you use it.

Time is of the essence as the program has technically expired. The time to claim the refund is running out. Don’t delay!

The IRS expects 70-80% of SMBs are good candidates for taking the ERC. If your business experienced disruptions to commerce, travel, or group meetings due to a government order, it might qualify! This includes supply chain disruptions, price increases, reduced hours, reduction in goods or services offered, were unable to travel, or attend conventions. Talk to one of our Refund Specialists to find out more.

ERC is a refundable payroll tax credit. Born out of the same CARES Act as PPP, its aim is to provide economic relief for small and medium businesses who retained employees during the COVID-19 pandemic. Initially, eligible employers could only take either PPP, or ERC. In 2021, as part of the Consolidated Appropriations Act, Congress amended this provision, allowing businesses to apply for both.

PPP was a forgivable loan. ERC returns the payroll taxes that your business has already paid. Once your business receives the ERC funds from the US Treasury, no further action is required on your part.

PPP was heavily marketed by the SBA, while ERC is claimed directly through the US Treasury. Along with our bank partners, it’s our mission to educate you and obtain for your business the payroll tax refund that it’s entitled to.

Refund, rebuild

With ERC Straightline, we make it simple to claim the capital that’s yours to cover operating expenses, grow your business, hire quality talent, pay off debt, build a safety net, and so much more. How much money could be waiting for your business?